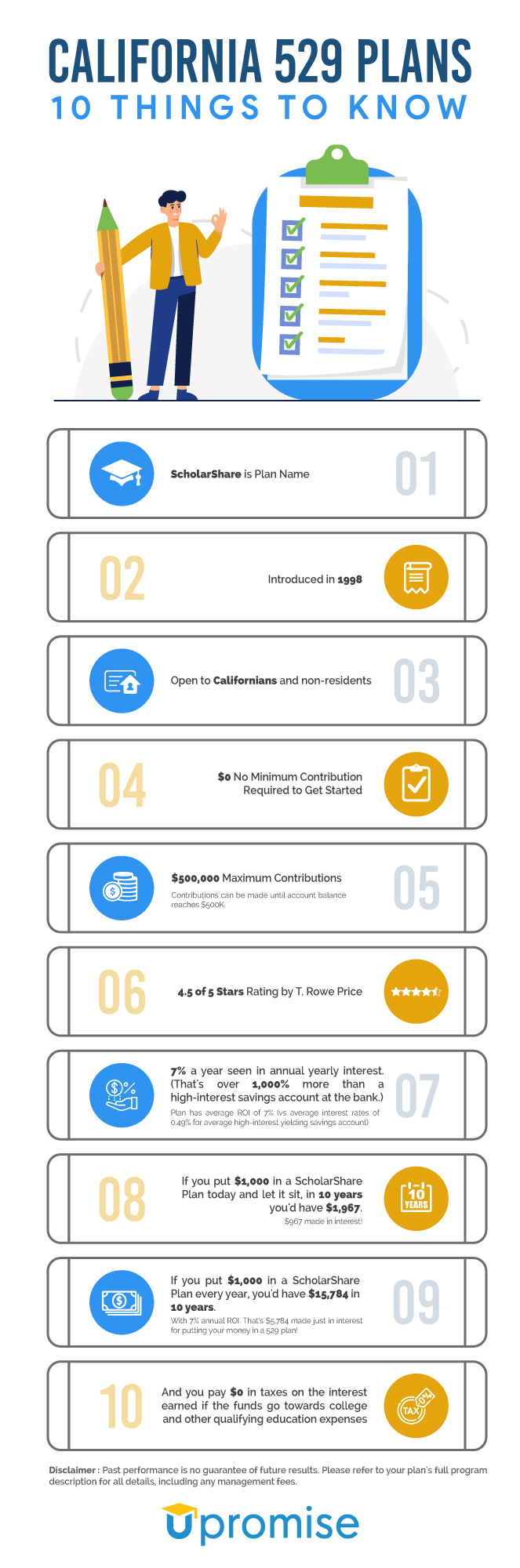

10 Quick Facts About California’s 529 College Savings Plan

- The name of California’s state-sponsored 529 plan is ScholarShare.

- ScholarShare was rolled out to Californians in 1998.

- But non-California residents can enroll, too. Any resident of the United States with a social security number can enroll.

- It’s free to enroll! While many 529’s require a minimum opening contribution, you can open a California ScholarShare 529 with literally $0 zero dollars.

- $500,000 is the max. Funds can be put into any/all 529 account balances for one unique beneficiary until the total account balances reach $500,000.

- T. Rowe Price gives the ScholarShare 529 Plan 4.5 of 5 stars.

- Funds in California’s 529 College Savings Plan see an annual rate of return of 7%. That’s more than 1,000% interest you’d get if you stuck your funds in a savings account at the bank.

- Put $1,000 in a ScholarShare plan and just let the money sit, and in 10 years you could have $1,967.

- Put $1,000 in a ScholarShare plan every single year for 10 years, you’d have $15,784. Assuming a 7% annual ROI, which means you could make $5,784 just by setting money into a 529 plan. $1,000 a year may seem like a lot, but it’s only $2.74 a day.

- Pay $0 in taxes on funds you take out of your 529 plan. As long as the funds go towards college or post-secondary tuition and other qualifying education expenses.

Did you know your ScholarShare 529 plan is eligible to be linked to the free Upromise Rewards program. Upromise has helped families save over $1 Billion for college. Join free and earn cash rebates and other free cash rewards to save money for college. Additionally, every month five (5) Upromise members win a $529 scholarship for their family’s futures scholar.

Related Articles:

- Kentucky 529 Plan Basics

- College Prep Resources Guide

- How to Select a 529 College Savings Plan

- Kansas 529 Plan Basics

- Tips and Tricks to Make Learning from Home Easier

- New Jersey 529 Plan Basics

- Nevada 529 Plan Basics

- Guide to Budgeting for College Students

- Minnesota 529 Plan Basics

- Pennsylvania 529 Plan Basics

- Maine 529 Plan Basics

- Montana 529 Plan Basics

- Are Student Loans Worth It?

- How to Make Online Learning More Engaging

All State 529 Plans by State

- Alabama 529 Plan

- Alaska 529 Plan

- Arizona 529 Plan

- Arkansas 529 Plan

- California 529 Plan

- Colorado 529 Plan

- Connecticut 529 Plan

- Delaware 529 Plan

- Florida 529 Plan

- Georgia 529 Plan

- Hawaii 529 Plan

- Idaho 529 Plan

- Illinois 529 Plan

- Indiana 529 Plan

- Iowa 529 Plan

- Kansas 529 Plan

- Kentucky 529 Plan

- Louisiana 529 Plan

- Maine 529 Plan

- Maryland 529 Plan

- Massachusetts 529 Plan

- Michigan 529 Plan

- Minnesota 529 Plan

- Mississippi 529 Plan

- Missouri 529 Plan

- Montana 529 Plan

- Nebraska 529 Plan

- Nevada 529 Plan

- New Hampshire 529 Plan

- New Jersey 529 Plan

- New Mexico 529 Plan

- New York 529 Plan

- North Carolina 529 Plan

- North Dakota 529 Plan

- Ohio 529 Plan

- Oklahoma 529 Plan

- Oregon 529 Plan

- Pennsylvania 529 Plan

- Rhode Island 529 Plan

- South Carolina 529 Plan

- South Dakota 529 Plan

- Tennessee 529 Plan

- Texas 529 Plan

- Utah 529 Plan

- Vermont 529 Plan

- Virginia 529 Plan

- Washington 529 Plan

- Washington DC 529 Plan

- West Virginia 529 Plan

- Wisconsin 529 Plan

- Private College 529 Plan